Content

These forms are submitted to HMRC with your self-assessment tax return. The SA104s is a short version of your company’s income if it is below £85,000 and the SA104F is the longer version if your company’s income is above £85,000 or if your company’s finances are less straightforward. A general partnership is similar to a joint venture whereby two partners go into business together and are equally responsible for the day to running of the business. We have a solution for your business or self-employment, no matter what industry you serve. Welcome to the number one Partnerships accounting specialist. We are AAT and ACCA qualified accountants taking care of everything.

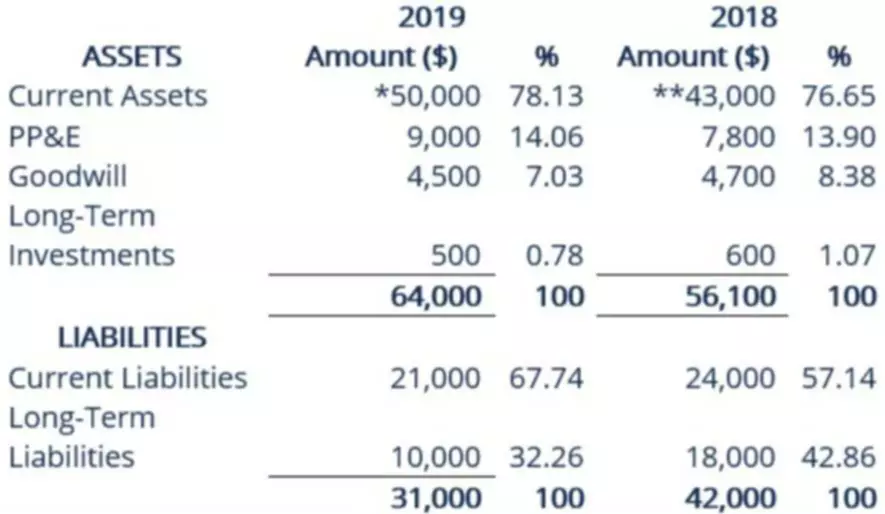

partnership accounting bring products and services that are interrelated to our core offerings. Together we deliver solutions that address the broader life cycle that our clients are engaged in and unlock their peak potential. The three most important financial statements produced by accounting software are the income statement, the balance sheet, and the cash flow statement.

Our Clients

Grow your business with continually evolving accounting solutions battle tested by world leading brands for three decades. Understand better how you’re doing financially with daily updates from your bank accounts and credit cards.

How do you account for a partnership?

How to Account for a Partnership. The accounting for a partnership is essentially the same as is used for a sole proprietorship, except that there are more owners. In essence, a separate account tracks each partner's investment, distributions, and share of gains and losses.

For three decades, Flexi has powered OEM and white label accounting solutions for world-leading brands. Our deep expertise and knowledge of the accounting nuances of many vertical industries provides unmatched capabilities to our industry partners. See why Flexi is the accounting platform of choice for companies like Allscripts, Sapiens, Optum , Change Healthcare, Acturis, Majesco, and one of the world’s leading global banking platforms. FundCount automates and streamlines the accounting for Sections 704b, 704c and 754. The software also supports all IRS approved partnership tax allocation methods, including aggregate full netting, tax lot layering, and more, allowing you to generate IRS K-1s out of the box. With automated accounting software, data entry is kept to a minimum.

Automate your day-to-day bookkeeping, leaving you more time to grow your business.

After selecting the proper category, transactions begin to populate the business’ financial statements. Business owners can run a financial report in seconds to review profitability, compare revenue and costs, check bank and loan balances, and predict tax liabilities. Having quick access to this financial information gives business owners the power to make important decisions. FINSYNC is one of the most popular accounting software for partnerships. FINSYNC is used for invoicing, project tracking, and cash flow management. While much of your daily accounting work probably involves paying bills, sending invoices, and recording payments, you also need to keep a close eye on your bank and credit card activity. If you have connected your financial accounts to your accounting service, then this is easy to accomplish.

We looked at 19 accounting software companies with specialized products for small businesses before choosing our top five software options. We considered cost, scalability, ease of use, reputation, and accounting features.

Best for Service-Based Businesses

It doesn’t have a dedicated time-tracking tool, comprehensive mobile access, or inventory management, though. The company has over 250 employees and was purchased by H&R Block in 2019. The foundational accounting features that most small businesses need, such as income and expense tracking, financial reporting, invoicing, and scanning receipts, are all included with this free software. Customer payment processing and payroll are considered premium services that cost extra, but all of the bookkeeping, invoicing, and reporting features are completely free. We recommend FreshBooks especially for sole proprietors and companies with perhaps an employee or two—though it’s capable of handling more. Very small businesses could use it for basic money management, like sending invoices, monitoring financial accounts, accepting payments, and tracking income and expenses. More complex companies can add advanced tools that include projects and proposals, mileage and time tracking, and reports.

- The SA104s is a short version of your company’s income if it is below £85,000 and the SA104F is the longer version if your company’s income is above £85,000 or if your company’s finances are less straightforward.

- These forms are submitted to HMRC with your self-assessment tax return.

- The best way to keep track of these metrics is by using accounting software.

- FundCount even handles series of shares and equalization accounting.

- We recommend reading our in-depth review of any service first to make sure it fits your needs—and your budget.

Create your free account today to get started with refreshingly simple bookkeeping software. Get the most out of Pandle with in-built tours, guides and free live chat support provided by real people – so you will always have access to the answers you need, when you need them.

Zoho Books

Accounting software reduces the amount of time spent on data entry by allowing users to sync their business bank accounts and credit cards with the software. Once synced, transactions will flow into the accounting software, where they can be categorized into various accounts. While most accounting software is easy to use, a general understanding of accounting principles is needed to ensure that financial reports are prepared correctly. For this reason, many businesses hire bookkeepers or accountants to maintain or review their books. Cloud-based online accounting software makes it convenient for businesses to access their books at the same time as their bookkeeper or accountant. Each plan offers more advanced features like inventory management, time tracking, additional users, and cash flow.

- We use our own highly specialized partnership accounting software to track complex partnership transactions including capital contributions, calls and distributions as well as transferring or gifting of underlying assets.

- Wealth management technology and outsourced service solutions for family offices and financial institutions.

- We hope that one of them will serve perfectly in your small business.

- They reconcile your accounts and close your books at month’s end to prevent errors.

- If you want to put your education and experience to use in a customer success capacity and work with happy clients by adding value on a daily basis, then this is the perfect opportunity for you!

The https://www.bookstime.com/ app makes it easy to track mileage while driving and capture photos of receipts for business expenses. Most accounting software is not designed to separate business transactions from personal transactions, but a special feature of QuickBooks Self-Employed provides an option to mark each transaction as business or personal. This is helpful for freelancers who don’t have a separate bank account for their business activity.